Homeowners Insurance in and around Graham

Homeowners of Graham, State Farm has you covered

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

New home. New adventures. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help cover your home in case of windstorm or hailstorm, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they got hurt at your residence, the right homeowners insurance may be able to cover the cost.

Homeowners of Graham, State Farm has you covered

The key to great homeowners insurance.

Homeowners Insurance You Can Trust

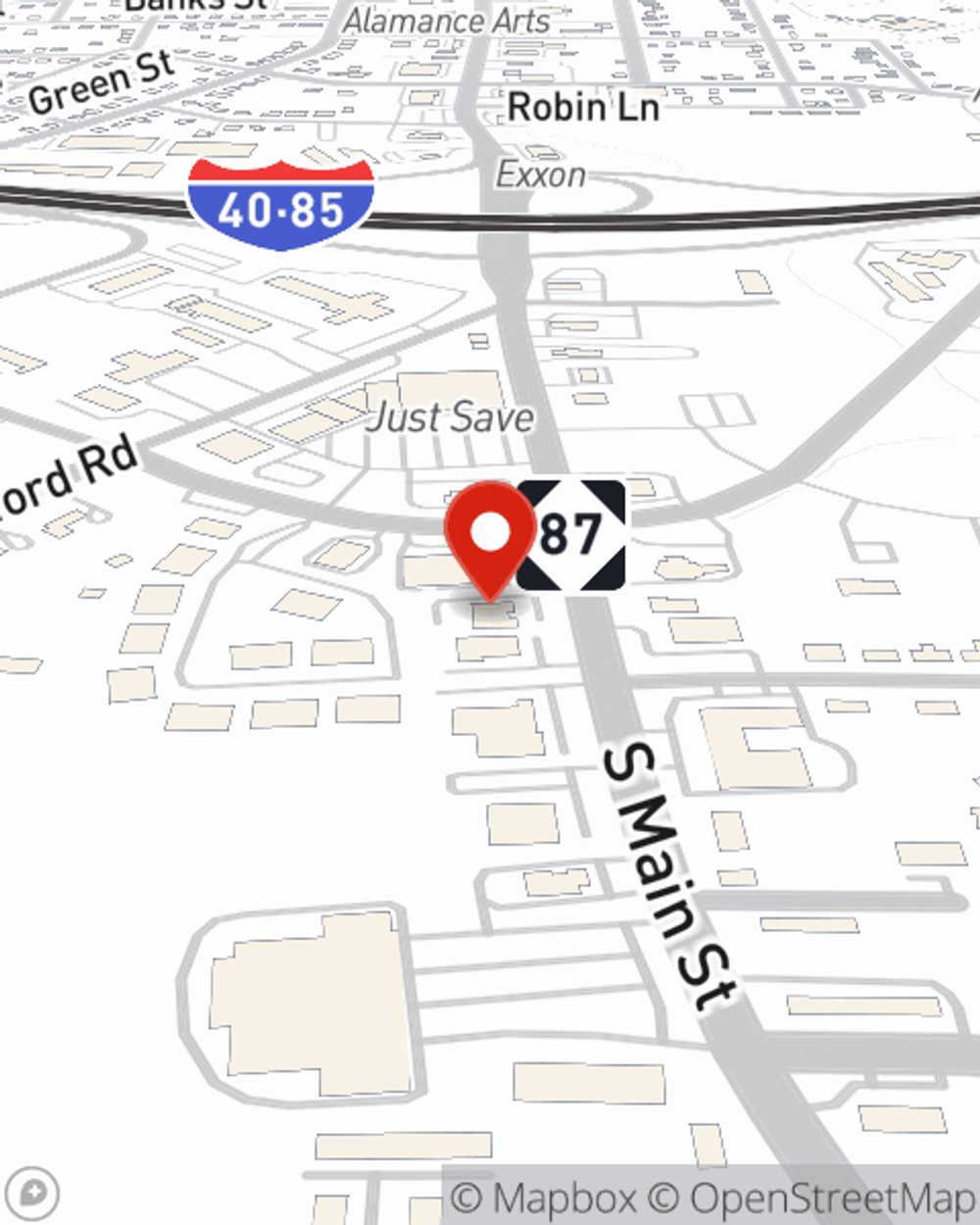

Protection for your home from State Farm is a great next step. Just ask your neighbors. And contact agent Mike Shoffner for additional assistance with finding a policy that fits your needs.

Let us help with the details of insuring your home with State Farm's excellent homeowners insurance. All you need to do to lay the foundation is reach out to Mike Shoffner today!

Have More Questions About Homeowners Insurance?

Call Mike at (336) 570-0416 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Safer door hinges to make your home more secure

Safer door hinges to make your home more secure

There is a connection between door hinges and home security. Certain door hinge designs may help keep your home secure.

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.

Mike Shoffner

State Farm® Insurance AgentSimple Insights®

Safer door hinges to make your home more secure

Safer door hinges to make your home more secure

There is a connection between door hinges and home security. Certain door hinge designs may help keep your home secure.

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.